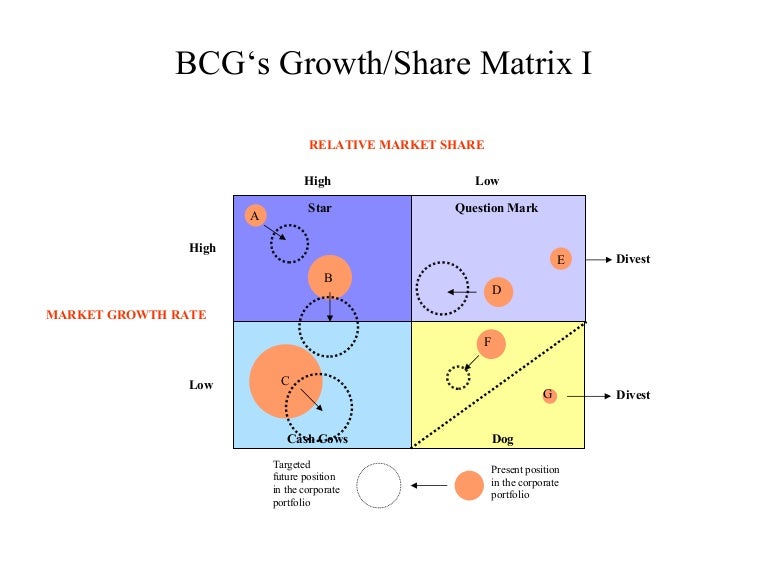

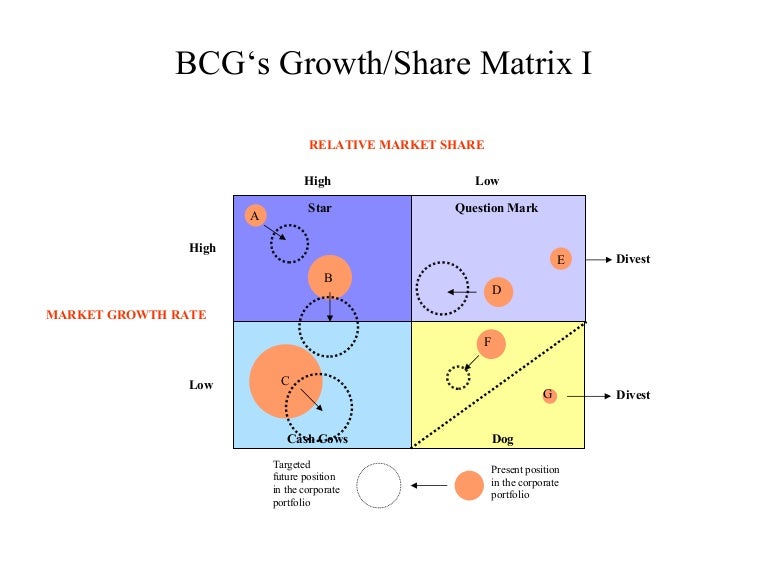

In fact, if the rate of return exceeds the growth rate, the cash cannot be reinvested indefinitely, except by depressing returns. This excess need not, and should not, be reinvested in those products. Products with high market share and slow growth are “cash cows.” Characteristically, they generate large amounts of cash, in excess of the reinvestment required to maintain share. The payoff is cash that cannot be reinvested in that product. The payoff from growth must come when the growth slows, or it never will. No product market can grow indefinitely.

Buying market share requires an additional increment of investment.

High market share must be earned or bought.

The added cash required to hold share is a function of growth rates.

Growth requires cash input to finance added assets. This is a matter of common observation, explained by the experience curve effect. High margins and high market share go together. Margins and cash generated are a function of market share. Both kinds are needed simultaneously.įour rules determine the cash flow of a product. Low growth products should generate excess cash. High growth products require cash inputs to grow. The portfolio composition is a function of the balance between cash flows. To be successful, a company should have a portfolio of products with different growth rates and different market shares. Technology, Media, and Telecommunications.

0 kommentar(er)

0 kommentar(er)